Risk processes with tax

Dalal Al Ghanim

Ronnie Loeffen

Alex Watson

· UCL Stats Internal Seminar, 17 July 2020

- Loss-carry-forward: tax paid at the maximum

- What is the best tax rate to maximise revenue?

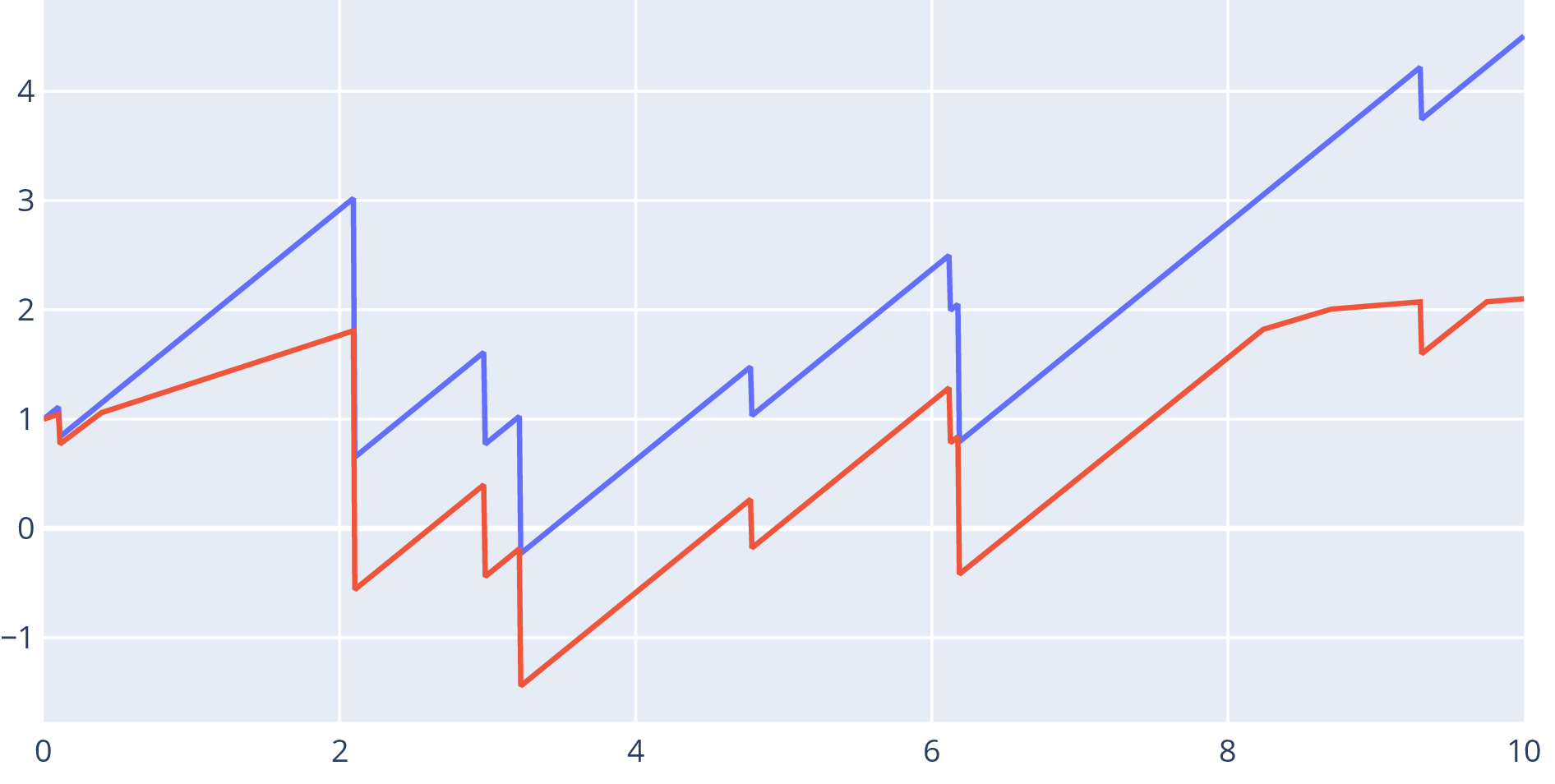

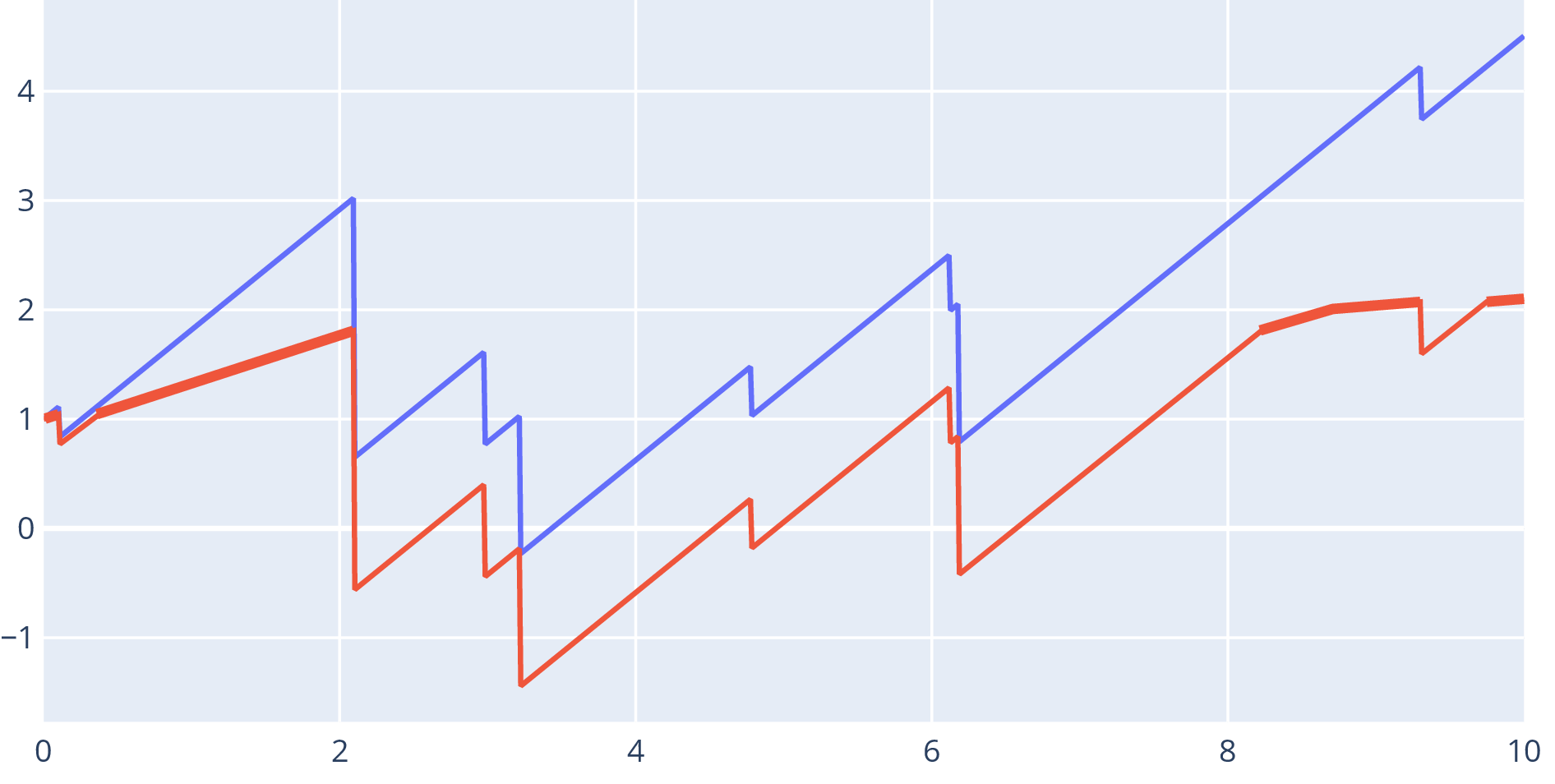

- Risk process: with Poisson process, i.i.d.

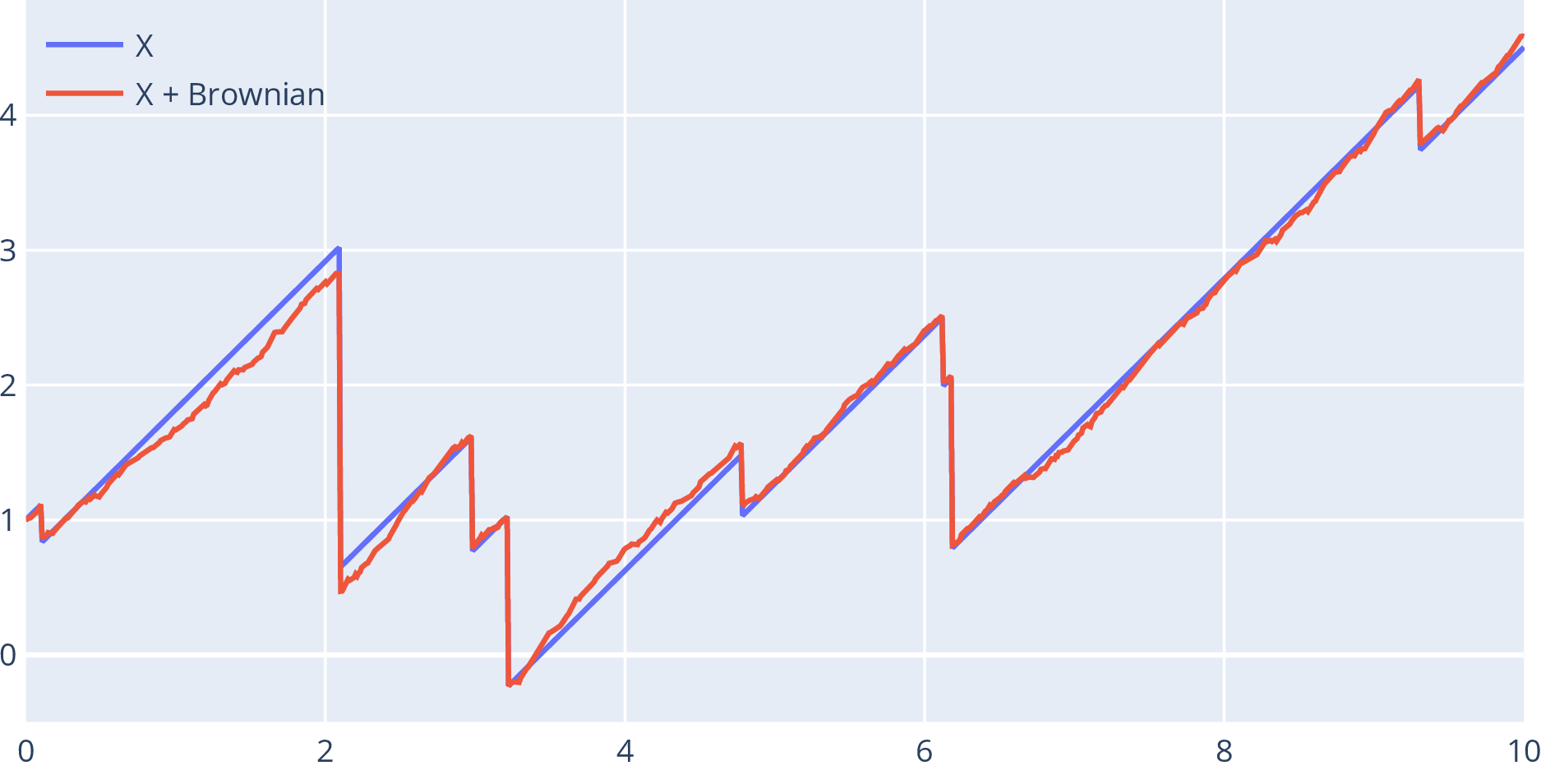

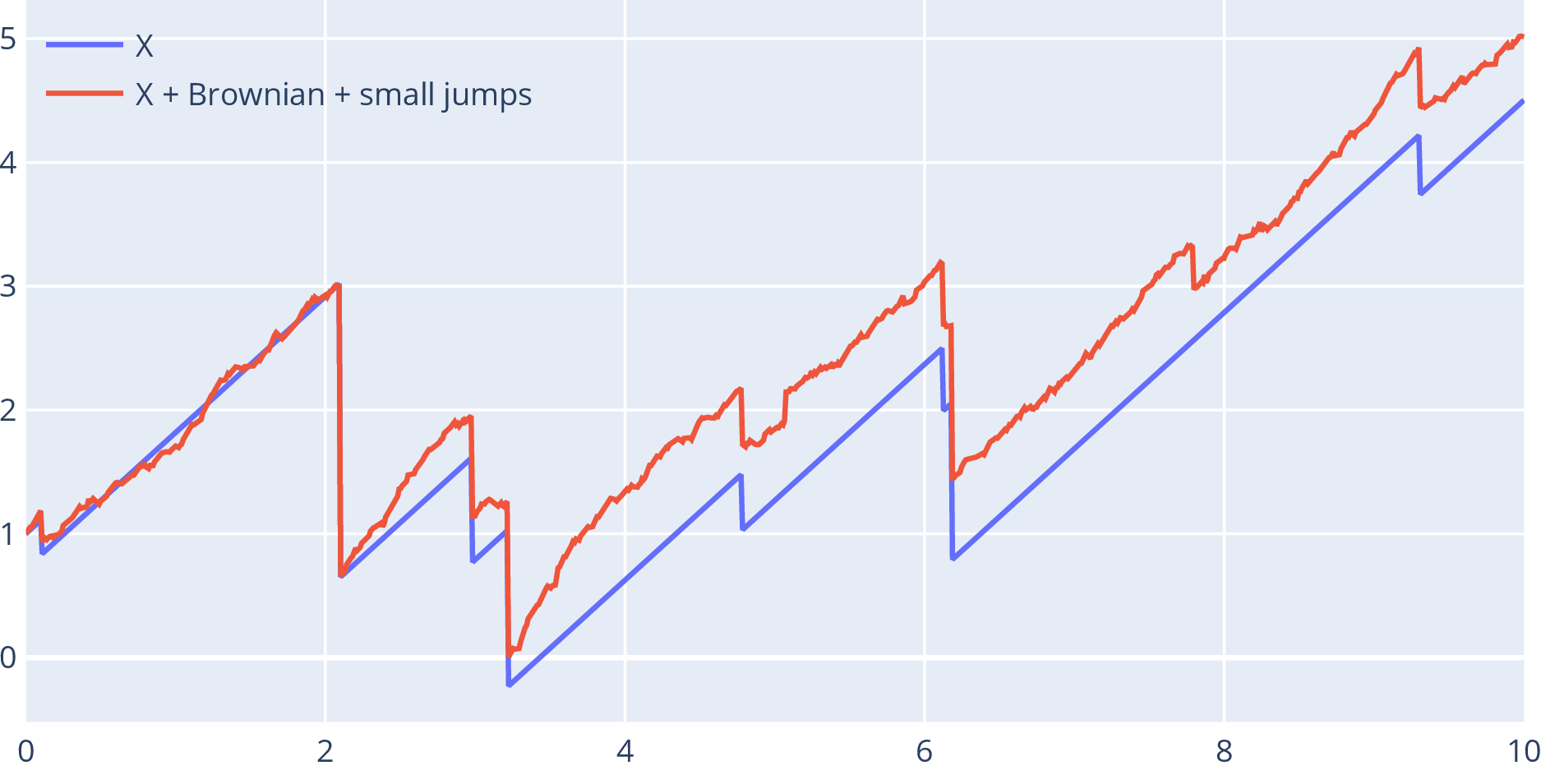

- Can include Brownian part and fast, small jumps : Lévy process

- Wealth of insurance company: is premium rate, are claims

- Intrinsic motivation: continuous equivalent of random walk

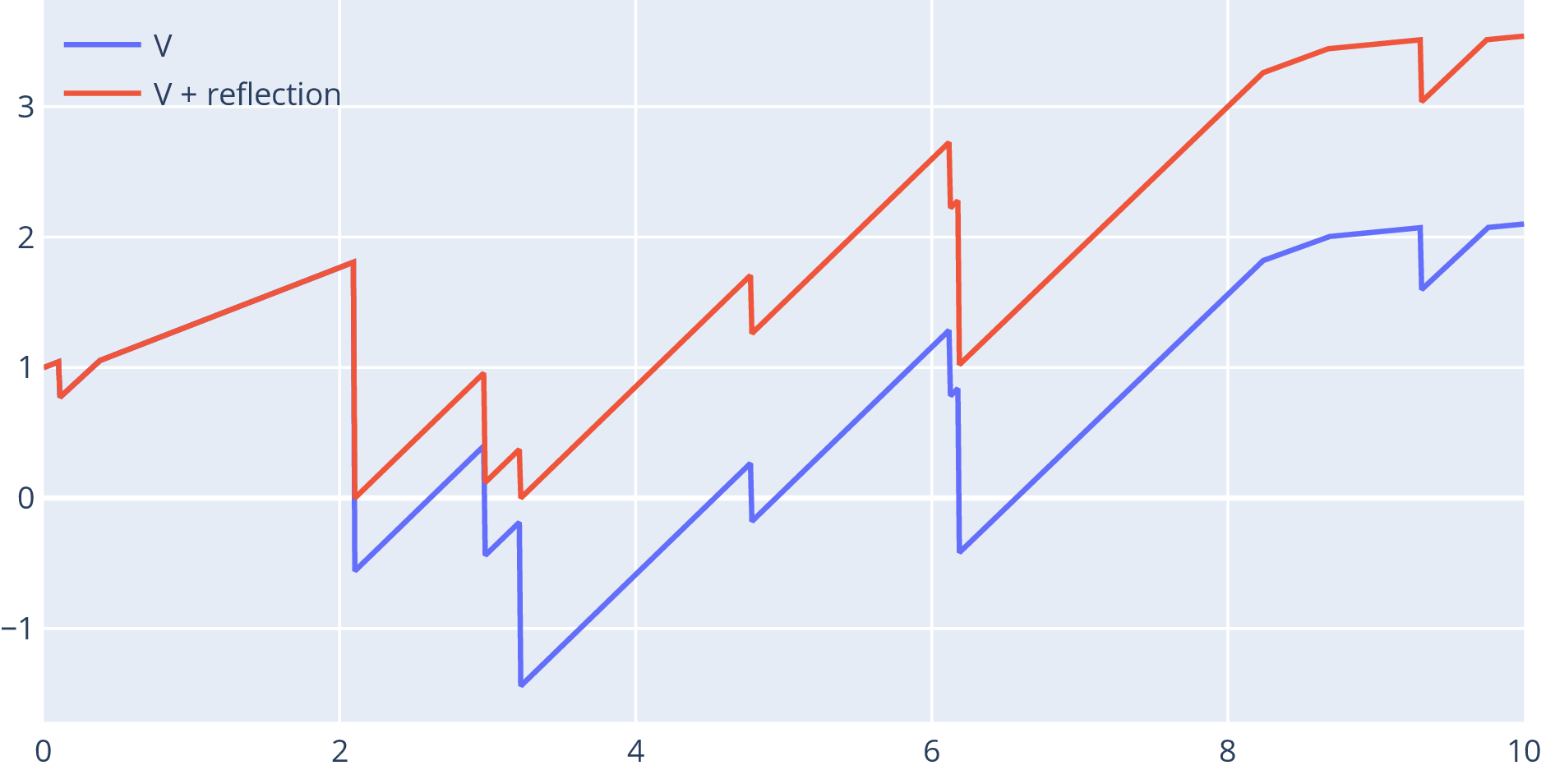

Tax process – partially reflected

- is the tax rate in loss-carry-forward taxation

- Introduces spatial dependence in a tractable way

- Questions: existence? computation of functionals? optimal ?

Two ideas in literature:

- – not obvious it exists – is Markov

- – clear that it exists – is not Markov

Theorem – Al Ghanim, Loeffen, W. (2020)

If the differential equation

has a unique solution, then the equation

has a unique solution .

- Let .

- satisfies the equation for : existence

- Converse direction: uniqueness

- Core idea: look at and while they are drifting at the maximum

Theorem – Al Ghanim, Loeffen, W. (2020+)

Assume , for , satisfies:

- if or ,

- if ,

where is the generator of (acting on coordinate ). Then, .

for is the condition for to be in the domain of the generator of

- Apply to get

where are scale functions (with known Laplace transform).

- Not the only way, but:

- Flexible

- Can guess with some dodgy method, and verify with the theorem

- Reduces need for excursion theory or approximation by bounded variation processes

- Process reflected below at zero: ‘capital injections’ or ‘bail-outs’

- Conditions for ‘’

are:

- if , and if ,

- if ,

- Only change is in boundary conditions

- What is the best tax rate to maximise revenue?

- For a predictable process, define , under which

- If , this is a tax process

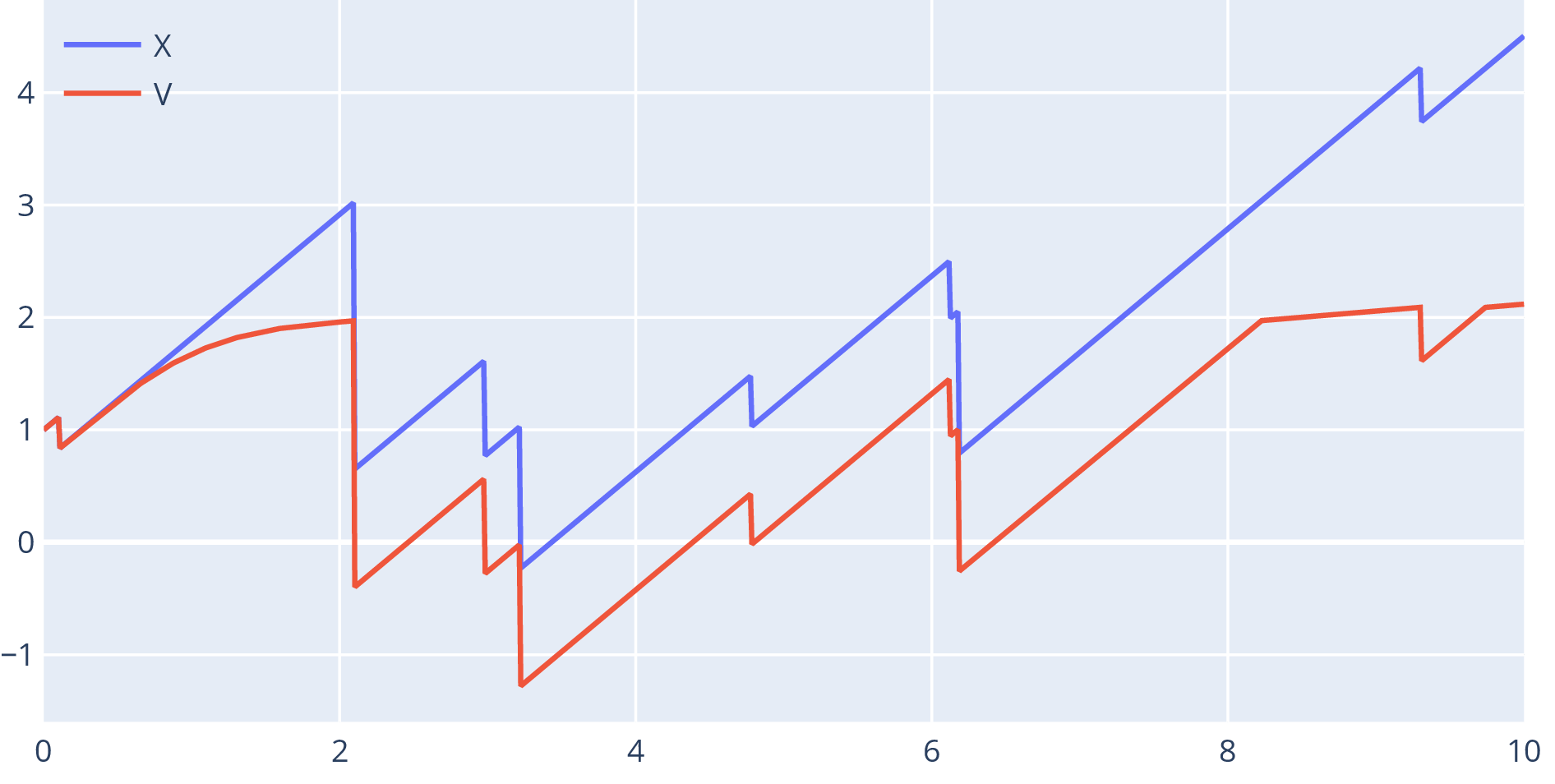

- If totally free to choose: reflection above (at some level), i.e.

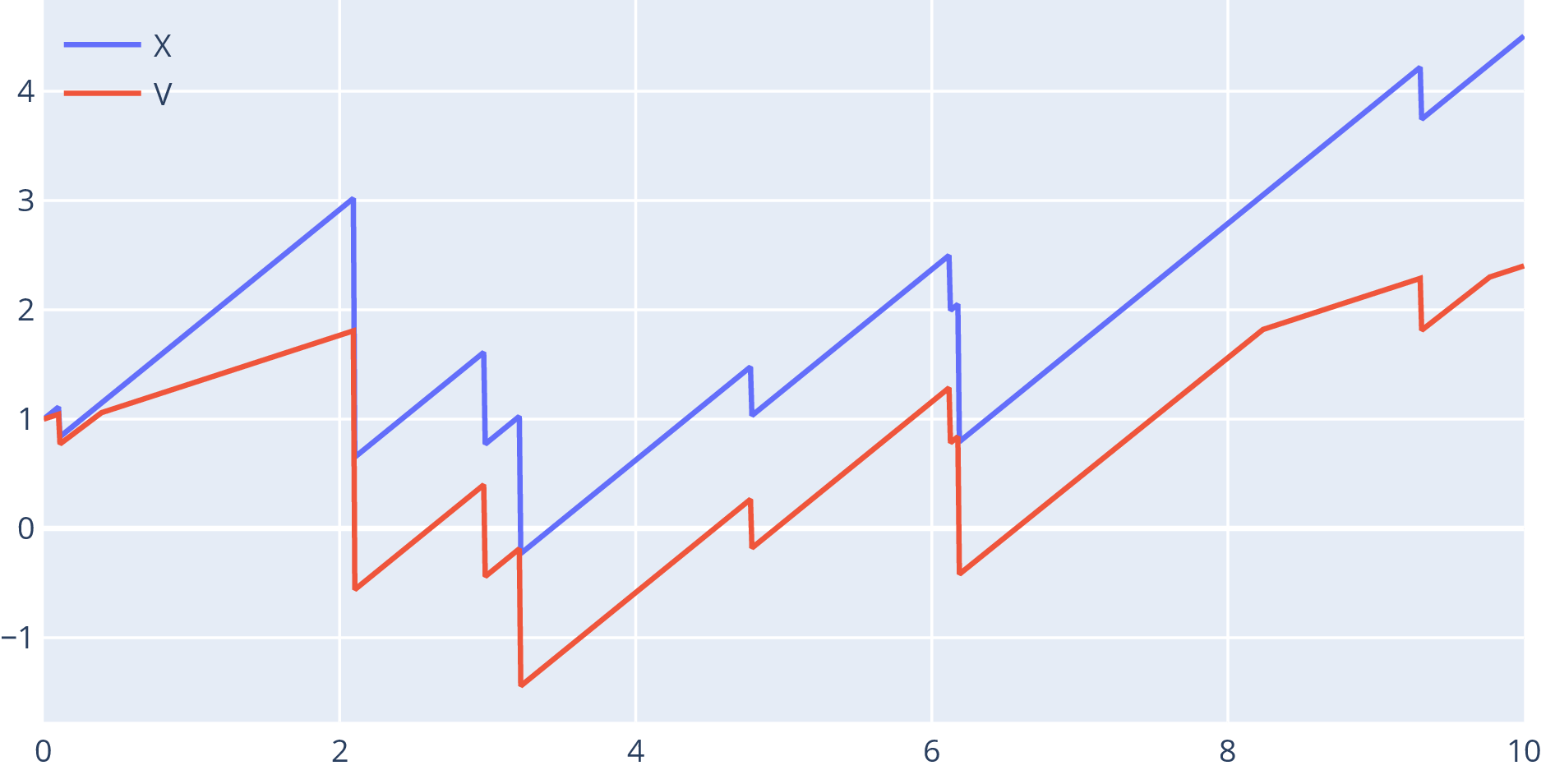

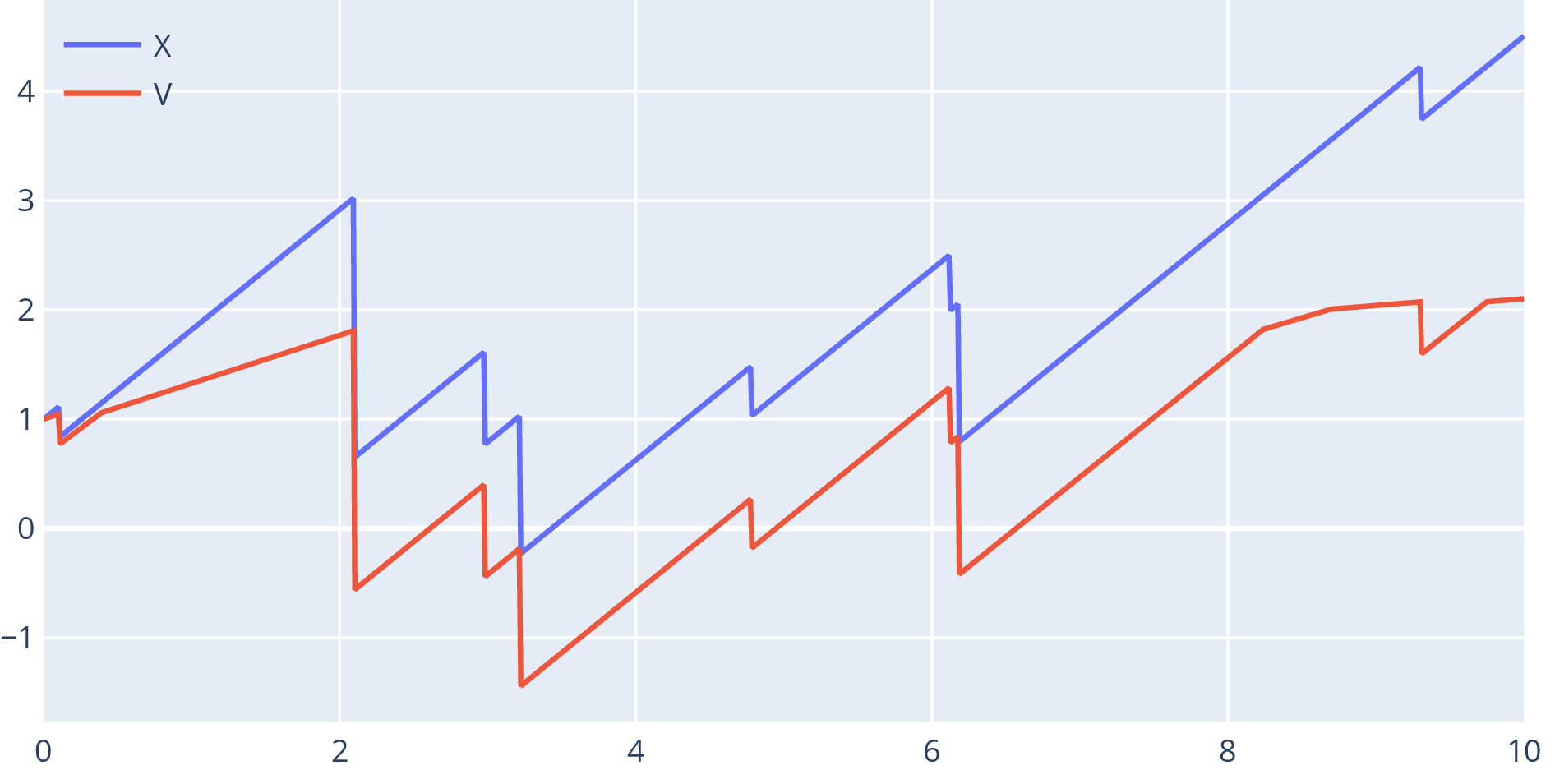

- If tax rate constrained to :

switch from

to when

crosses

some level ,

i.e. ,

- Extension to maximising tax revenue minus bail-out cost, etc. – many possibilities

- Solutions are explicit (in terms of scale functions)

Optimal control: explicit result

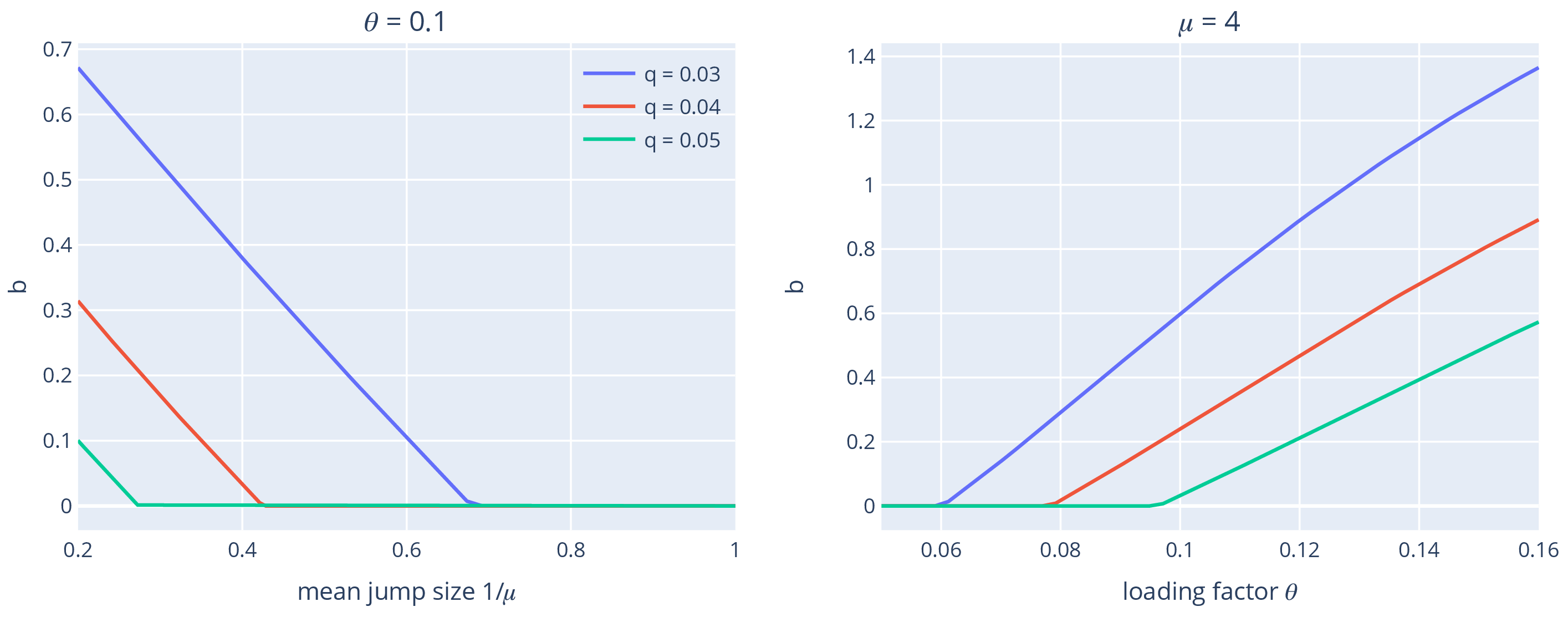

- Assumption: the tail of the Lévy measure is log-convex

- Think of the Lévy measure as , where is the rate of the Poisson process of jumps, and is the distribution of the jumps

- Optimal taxation is of form

- Let

- iff , otherwise is the unique root of

A quirk, or, didn’t someone do this 8 years ago?

- Wang and Hu (IME, 2012): optimal control of tax rates

- Their solution is equivalent to ours

- But it is expressed in terms of an optimal

- Years later we showed and tax rates are equivalent (1st theorem from today)

- We optimise over all tax rates (predictable )

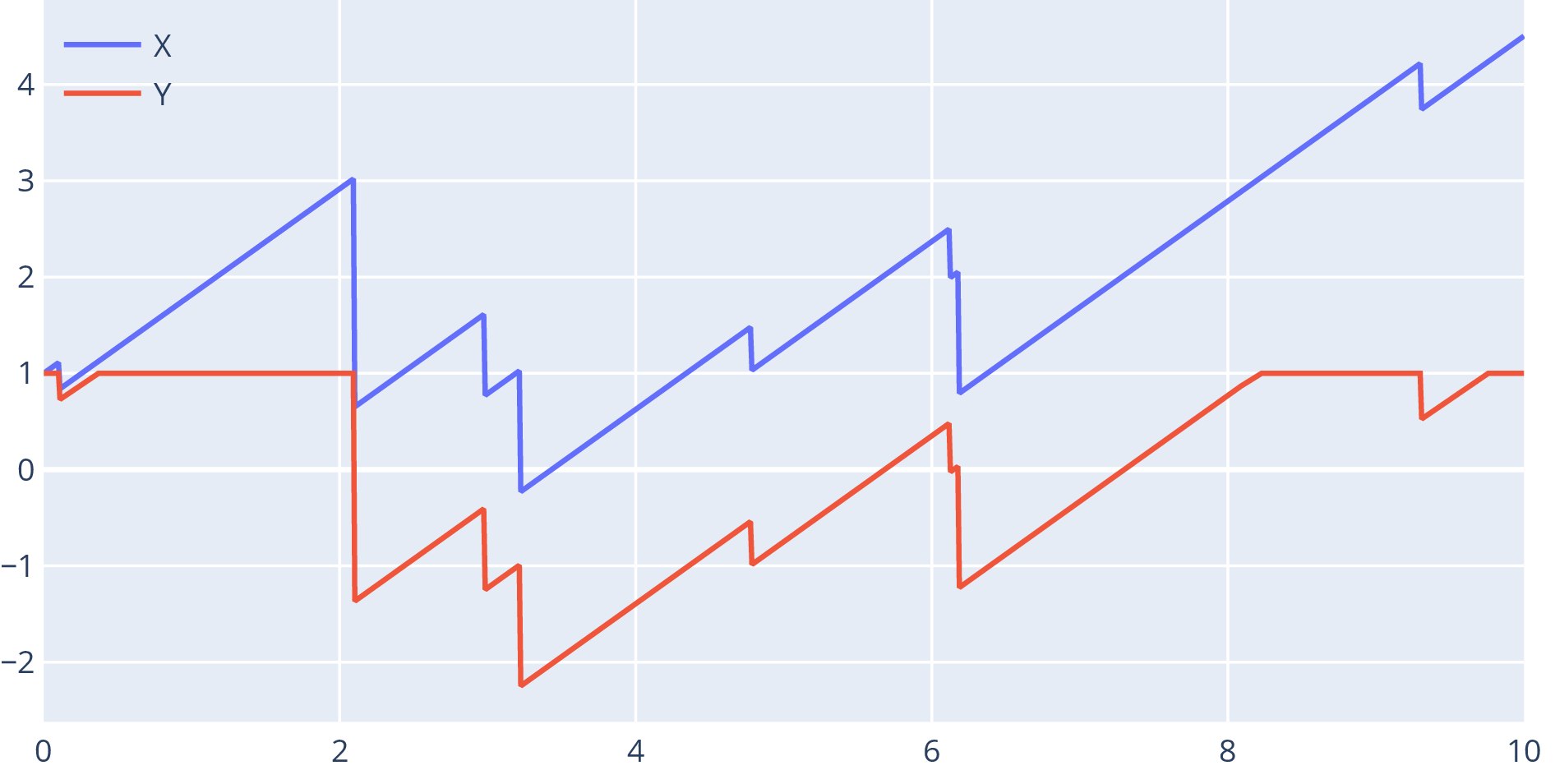

- a -Poisson process; i.i.d. exponential with rate (mean )

- is ‘loading factor’: ,

References

[1] D. Al Ghanim, R. Loeffen and A. R. Watson The equivalence of two tax processes Insurance Math. Econom., 2020. doi:10.1016/j.insmatheco.2019.10.002.

Thank you!